E-Invoicing in Malaysia: A Game Changer Starting August 2024

What is E-Invoicing?

E-invoicing is the electronic exchange of invoices between suppliers and buyers, reducing manual work and errors. Malaysia will introduce e-invoicing in August 2024 to streamline business operations and enhance efficiency. This aligns with global digital trends and aims to improve the country’s economy

Why is Malaysia Adopting E-Invoicing?

Efficiency and Cost Reduction

E-invoicing significantly reduces the time and costs associated with processing paper invoices. Businesses can automate their invoicing processes, which leads to faster payments and improved cash flow management.

Enhanced Compliance and Transparency

E-invoicing allows for better compliance with tax regulations. It ensures that all transactions are accurately reported and easily traceable, which helps in minimizing tax evasion and fraud.

Environmental Benefits

By reducing the reliance on paper, e-invoicing supports environmental sustainability. It decreases the carbon footprint associated with printing, mailing, and storing paper invoices.

Global Competitiveness

As many countries worldwide are adopting e-invoicing, Malaysia’s move will help local businesses stay competitive on the global stage. It facilitates smoother cross-border trade by aligning with international standards.

The Rollout Plan.

Phased Implementation Plan

Initial Phase:

Start Date: August 2024.

Target Audience: Larger corporations and businesses with significant transaction volumes.

Purpose: By starting with larger entities, the IRB aims to test the system with high transaction volumes to ensure its robustness. This allows for the identification and resolution of any issues before the system is rolled out more broadly.

Subsequent Phases:

Target Audience: Small and Medium-sized Enterprises (SMEs).

Purpose: After refining the system during the initial phase, the IRB will extend e-invoicing to SMEs. This gradual rollout helps mitigate risks and ensures that the system can handle the diverse needs of different business sizesRegistration and Compliance

Registration with IRB:

- Mandatory: All businesses, starting with those in the initial phase, are required to register with the IRB for e-invoicing.

- Process: Registration involves submitting necessary business information and getting approval from the IRB to participate in the e-invoicing system.

E-invoicing Software:

- Compliance: Businesses must adopt e-invoicing software that meets IRB’s stipulated guidelines.

- Functionality: The software should be capable of generating, transmitting, receiving, and processing electronic invoices in the required format.

Benefits of E-invoicing Implementation

Efficiency

Reduces time and costs associated with manual invoicing processes

Accuracy

Minimizes errors through automated data entry and processing.

Speed

Speeds up invoice processing and payment cycles.

Challenges and Considerations

- Initial Setup Costs: Implementing an e-invoicing system involves initial costs for software and training.

- Change Management: Adapting to new processes requires changes in workflow and employee training.

- Integration with Existing Systems: Businesses need to ensure that their e-invoicing solution integrates seamlessly with their current accounting and ERP systems.

Einvoice FAQs

What is an e-Invoice?

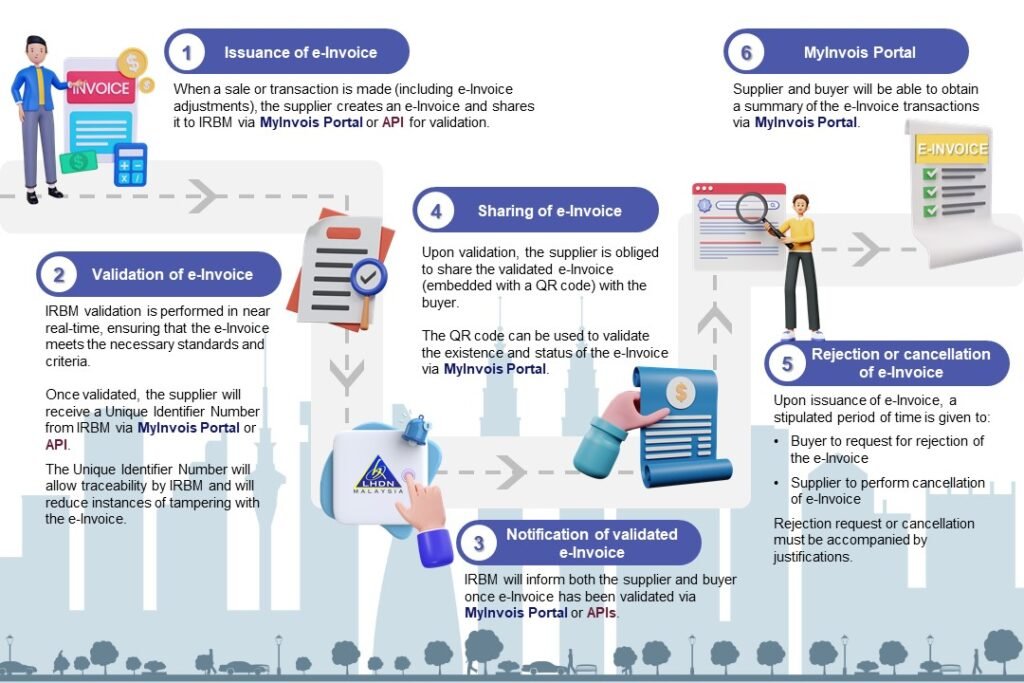

An e-Invoice is a digital representation of a transaction between a supplier and a buyer, formatted in a structured, machine-readable manner. It is a file created in the format specified by the IRBM (i.e., in XML or JSON file format) and not in the form of PDF, JPG and etc.

Is e-Invoice applicable to transactions in Malaysia only?

No, the issuance of e-Invoice is not limited to only transactions within Malaysia. It is also applicable for cross-border transactions.

Are all businesses required to issue e-Invoice?

Yes, all taxpayers undertaking commercial activities in Malaysia are required to issue e-Invoice, in accordance with the phased mandatory implementation timeline. Refer to Section 1.5 of the e-Invoice Guideline for further details.